Build Wealth Without Earning More

Jan 02, 2026

The Lie We’ve All Been Sold

For most people, wealth feels like something just out of reach.

Not because they’re lazy.

Not because they don’t earn enough.

But because they were taught the wrong equation:

More income = more wealth

If that were true, high earners wouldn’t feel anxious, stuck, or uncertain about their future. Business owners wouldn’t generate six or seven figures and still struggle to pay themselves consistently. Professionals wouldn’t wonder where all the money went at the end of the month.

The truth is uncomfortable—but freeing:

Wealth is not built by income alone.

It’s built by how you manage, direct, protect, and repeat what you already have.

This page explains:

- Why earning more often fails

- What actually builds wealth

- How to start without overwhelm

- How to stop sabotaging yourself financially

- How small decisions compound into long-term security

And most importantly:

how to begin building wealth without waiting for a raise, promotion, or perfect moment.

Why Income Doesn’t Equal Wealth

Income is a tool—not a result.

On its own, income does three things:

- Gives you spending power

- Increases decision complexity

- Magnifies existing habits

If your habits are unclear, emotional, or reactive, more income simply accelerates stress.

That’s why many high earners:

- Live paycheck to paycheck

- Avoid looking at their finances

- Feel guilty despite “doing well”

- Have little margin for mistakes

This isn’t a discipline problem.

It’s a structure problem.

Without structure, money leaks quietly:

- Through lifestyle creep

- Through unintentional spending

- Through delayed decisions

- Through avoidance disguised as “being busy”

Wealth doesn’t come from income growth alone.

It comes from control, clarity, and consistency.

The Difference Between Being Busy With Money and Being Intentional

Most people are active with money—but not intentional.

They:

- Pay bills

- Move money between accounts

- Chase tools, apps, and advice

- React to emergencies

But activity is not direction.

Intentionality asks different questions:

- Why is this money going here?

- What future does this decision support?

- What problem does this solve?

- What pressure does this reduce?

Wealth grows when decisions are:

- deliberate

- repeatable

- aligned with long-term outcomes

That alignment—not hustle—is what separates earners from builders.

What Actually Builds Wealth (The Four Drivers)

Wealth is built when four drivers work together.

Miss one, and progress stalls.

1. Behavior: Decisions Under Pressure

Money decisions are rarely logical in real life.

They’re made:

- when you’re tired

- when you’re stressed

- when something breaks

- when someone else needs help

Your financial behavior under pressure matters more than your plan on paper.

Wealthy systems assume:

- you’re human

- you’ll feel fear

- you’ll make mistakes

They are designed to absorb impact, not require perfection.\

2. Structure: Systems Over Willpower

Willpower is unreliable.

Structure is dependable.

Structure looks like:

- automatic allocations

- defined priorities

- separated accounts

- clear decision rules

Structure removes friction from good decisions and friction adds up.

This is why budgeting often fails—not because it’s wrong, but because it asks humans to perform perfectly in imperfect conditions.

3. Intentional Allocation: Directing Money With Purpose

Wealth isn’t about saving everything.

It’s about directing money intentionally:

- toward safety

- toward opportunity

- toward future optionality

Unintentional money disappears quietly.

Intentional money compounds—even in small amounts.

4. Consistency: Small Actions Repeated

Wealth is rarely the result of one big move.

It’s the result of:

- consistent habits

- repeated decisions

- boring actions done well

The goal isn’t intensity.

It’s repeatability.

The 10% Power Play: Why Small Allocations Matter

One of the biggest myths in wealth building is that meaningful progress requires large amounts of money.

It doesn’t.

What it requires is consistency plus direction.

The “10% Power Play” isn’t about a number.

It’s about a mindset shift:

“I will intentionally direct a portion of my money before it disappears.”

That portion might be:

- 10%

- 5%

- 2% at the beginning

The amount matters less than the habit.

Why this works:

- It builds margin

- It restores confidence

- It creates optionality

- It reduces anxiety

Wealth starts when money is assigned a job instead of reacting to emergencies.

Personal Resources: The True Wealth Springboard

Before investing.

Before optimization.

Before advanced strategies.

Wealth begins with personal resources:

- emergency buffers

- cash flow margin

- decision clarity

- financial breathing room

Without personal resources:

- every expense feels urgent

- every market drop feels terrifying

- every decision feels permanent

With personal resources:

- stress drops

- choices expand

- confidence returns

This is why chasing returns without foundations backfires.

The Financial Domino Effect: Why One Win Changes Everything

Most people think financial breakthroughs happen all at once.

They don’t.

They happen when one key decision:

- removes pressure

- creates breathing room

- restores control

That one decision becomes:

- emotional relief

- mental clarity

- behavioral momentum

Examples:

- building a small emergency buffer

- automating one savings habit

- eliminating one recurring leak

- separating business and personal money

That first domino matters more than the tenth.

Stop Mugging Yourself™: The Cost of Self-Sabotage

Many people don’t lose money because of bad luck.

They lose it because of quiet self-sabotage:

- avoiding clarity

- delaying decisions

- reacting emotionally

- outsourcing responsibility

“Mugging yourself” doesn’t look dramatic.

It looks like:

- “I’ll deal with it later”

- “I don’t want to see the numbers”

- “I’m doing okay compared to others”

- “I’ll fix it when things slow down”

Wealth requires honesty—not shame.

Clarity is not punishment.

It’s protection.

Why Earning More Often Makes Things Worse

Without structure, earning more:

- increases spending expectations

- increases lifestyle obligations

- increases complexity

- increases pressure

More income without intention is just bigger stakes.

This is why so many people:

- earn more but save less

- upgrade lifestyles but not security

- feel trapped by success

Wealth isn’t about keeping up.

It’s about building freedom.

How to Start Building Wealth (Without Overwhelm)

You don’t need a perfect plan.

You need:

- awareness

- prioritization

- one clear next step

Here’s what works:

- Understand where you are

- Identify what matters most

- Choose one stabilizing action

- Build momentum before complexity

Trying to fix everything at once guarantees burnout.

Clarity beats intensity every time.

The Role of Time (And Why Patience Wins)

Wealth rewards patience—not perfection.

Time amplifies:

- consistency

- structure

- behavior

This is why:

- simple strategies outperform complex ones

- boring systems beat flashy tactics

- steady progress wins long-term

The goal isn’t speed.

It’s durability.

How This All Fits Together

Wealth without earning more happens when:

- income becomes a tool, not a crutch

- decisions are intentional

- systems replace willpower

- behavior is aligned with long-term outcomes

This isn’t about deprivation.

It’s about direction.

Your Best Next Step (Start With Clarity)

You don’t need to guess what to do next.

The fastest way to build momentum is to understand:

- where you are

- what’s holding you back

- what deserves your focus now

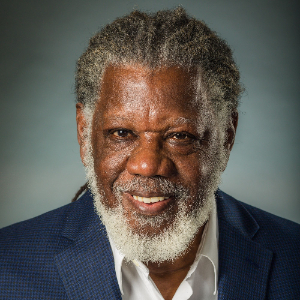

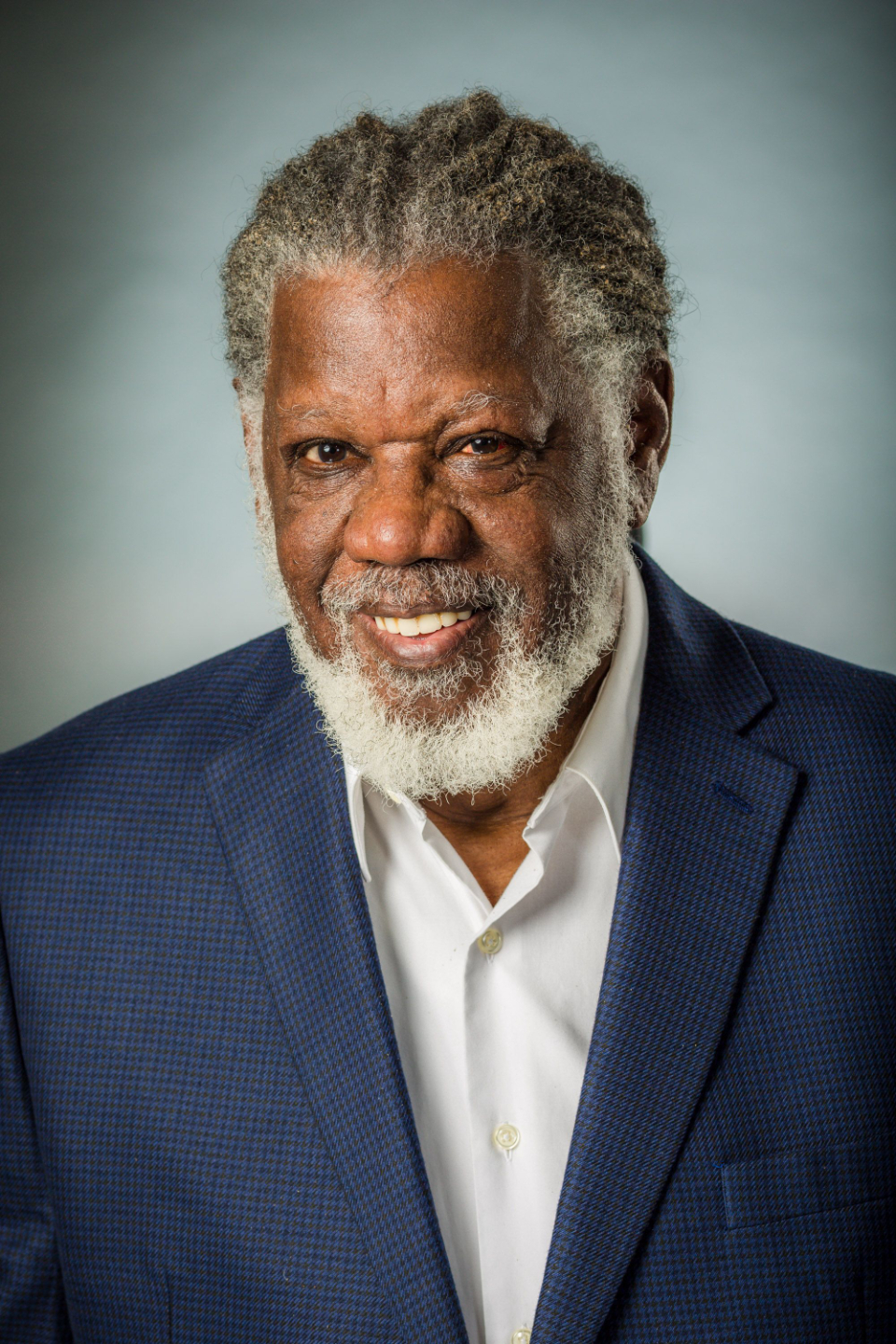

It takes about 2 minutes (Click the Image to take the Assessment)

There’s no pressure, no judgment, and no obligation.

Just clarity—and a better starting point. Wealth isn’t built by waiting for someday.

It’s built by small, intentional decisions made consistently—starting now, with what you already have.

You don’t need more income to begin.

You need clarity, structure, and direction.

Explore Related Foundations

We are spreading the word that financial clarity and freedom can be available for everyone. Live your best life and reach Higher Ground in a community of likeminded people.

We hate SPAM. We will never sell your information, for any reason.