The Springboard for Building Wealth: Why Personal Resources Are Key

Jun 09, 2025

When it comes to building wealth, most people jump straight to thoughts of investments, business ventures, or high-paying careers. While those are undoubtedly important, there’s a crucial, often overlooked foundation for lasting financial success: personal resources. The truth is, the process of building wealth doesn’t begin with your business or investment portfolio. It starts with something much more personal: your own financial habits, mindset, and resources. By building up your personal financial strength, you lay the groundwork for all future wealth-building endeavors.

What Are Personal Resources?

Personal resources encompass the assets and habits that you, as an individual, control. This includes your income, savings, spending habits, mindset, knowledge, and the way you manage your finances. It’s about taking charge of your personal financial situation before trying to create wealth through investments, side businesses, or real estate.

It may seem like a small step, but establishing a solid foundation of personal resources can have a ripple effect, helping you build the wealth you’ve always wanted. And here’s why: your personal financial strength is what gives you the freedom to make bold, informed decisions in all areas of life.

Why Personal Resources Matter for Wealth Building

- Financial Control Fuels Investment Success

If you don’t have control over your personal finances, it’s nearly impossible to take on new wealth-building opportunities. If you’re living paycheck to paycheck or accruing debt, you’ll lack the financial flexibility needed to invest in your future. Building up your personal resources first ensures you have the breathing room to take risks—whether that’s investing in stocks, buying property, or starting a business.

When you have a strong grasp on budgeting, saving, and debt management, you position yourself for opportunities that can create significant wealth down the road. With stable personal finances, you can confidently take the next steps, knowing you’re not sacrificing your financial security for a risky venture.

- Creating Financial Confidence

Financial confidence is not about knowing everything there is to know about money; it’s about understanding your personal financial situation and feeling empowered to make informed decisions. Many people avoid dealing with their finances because they feel overwhelmed, uncertain, or even ashamed. But by taking small, consistent actions—such as paying down debt, saving regularly, or learning basic investing principles—you develop confidence in your ability to manage money. This confidence translates into all areas of life, from making strategic career moves to seeking out new business opportunities.

This shift in mindset is essential. Once you take control of your personal resources, you’re more likely to take calculated risks that pay off in the long run.

- Wealth Building Is a Marathon, Not a Sprint

It’s easy to get caught up in the excitement of wealth-building strategies, but true wealth doesn’t come overnight. It’s the result of disciplined actions over time. That’s why personal resources are the key. They give you the stability to stay the course, even when things get tough.

Building wealth is often about making slow and steady progress: saving a little more each month, cutting unnecessary expenses, and investing consistently. Personal resources serve as the fuel to keep you moving toward your long-term goals. They help you weather economic downturns, unexpected expenses, or career setbacks without derailing your overall financial plan.

- Mental Mindset: Overcoming Scarcity Thinking

A critical aspect of building personal resources is shifting your mindset from scarcity to abundance. Many people view wealth-building as a zero-sum game, believing that there’s only so much to go around. This mindset leads to anxiety, poor decision-making, and missed opportunities.

But when you build your personal resources—by increasing your financial literacy, saving, and investing—you begin to cultivate an abundance mindset. This allows you to see opportunities where others may only see obstacles. You start to view money as a tool that works for you, instead of something you’re constantly chasing.

Practical Steps to Build Personal Resources

Building your personal resources takes time and effort, but it’s absolutely worth it. Here are some practical steps to get started:

- Master Your Budget: Start by tracking your income and expenses. Create a budget that aligns with your goals and ensures you're living within your means. This will give you control over your money and help you avoid unnecessary debt.

- Eliminate Debt: Pay down high-interest debt as quickly as possible. The less debt you have, the more resources you can redirect toward investments and savings.

- Start Saving: Even if it’s just a small amount, start saving consistently. Whether it’s for an emergency fund, a future investment, or retirement, putting money aside will help you build financial security and discipline.

- Educate Yourself: Take time to understand basic financial concepts like investing, taxes, and financial planning. The more knowledgeable you are, the better decisions you can make for your financial future.

- Set Clear Financial Goals: Define what wealth means to you and break it down into smaller, achievable goals. This could be saving for a down payment on a home, starting a business, or building a retirement fund.

The process of building wealth starts with your personal resources. When you take control of your finances—by mastering your budget, eliminating debt, and cultivating a growth mindset—you create the foundation for long-term financial success. Personal financial stability isn’t just about surviving today; it’s about building the resources you need to thrive in the future. By starting with yourself, you can unlock the door to financial freedom and wealth-building opportunities that will set you up for life.

If you're ready to start creating that foundation but aren't sure what the first steps look like, I’ve created something to guide you. It’s a free resource designed to help you build your first real financial cushion and gain the momentum you need to grow.

Grab your copy of the Free Freedom Fund Roadmap—a simple, actionable guide to help you build your first $5,000 and take control of your wealth journey.

Because real wealth doesn’t start with luck—it starts with you.

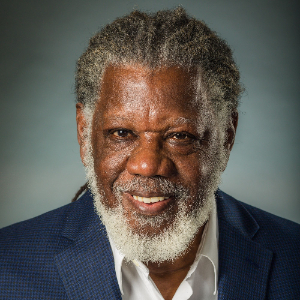

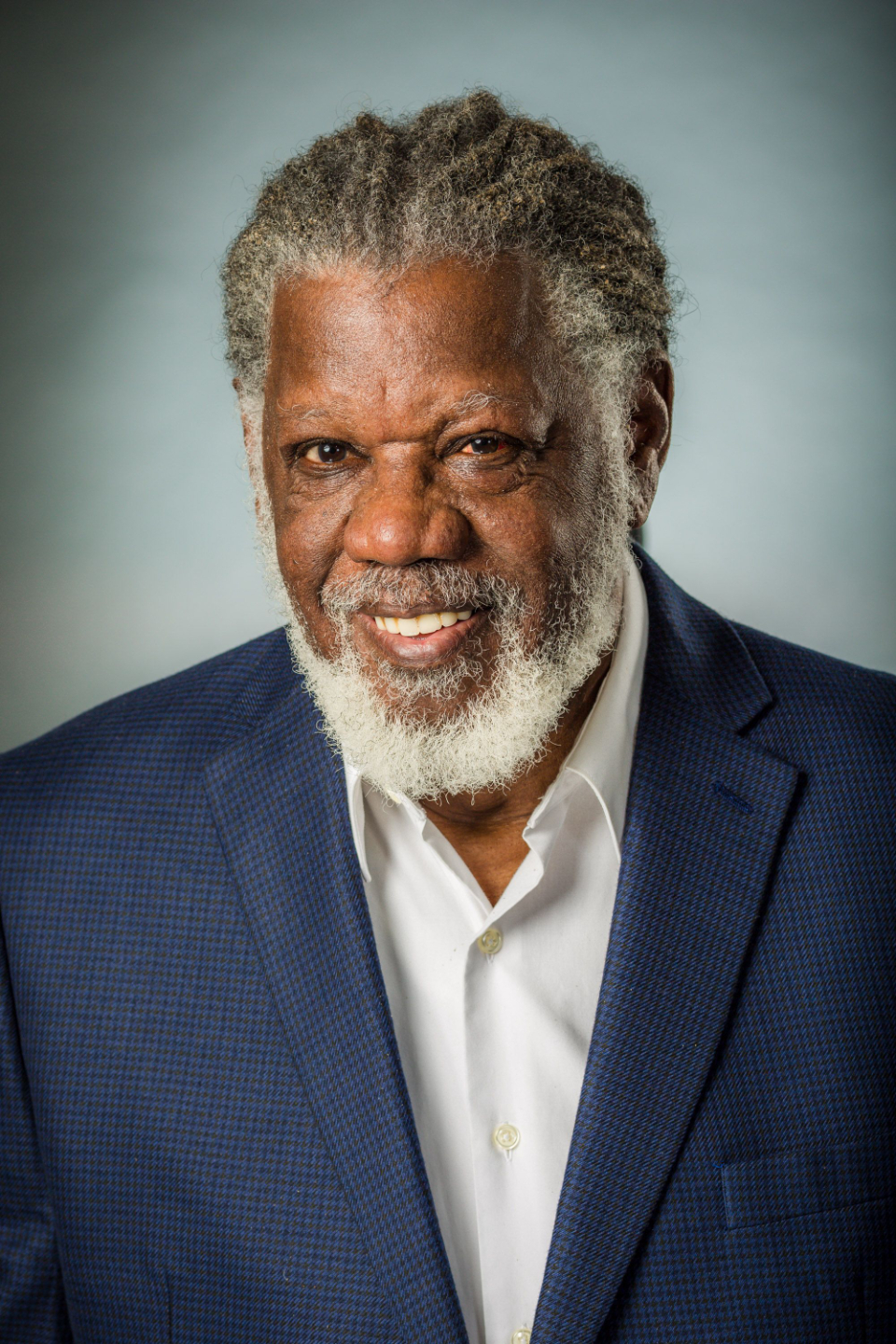

We are spreading the word that financial clarity and freedom can be available for everyone. Live your best life and reach Higher Ground in a community of likeminded people.

We hate SPAM. We will never sell your information, for any reason.