The Hidden Triggers Designed to Keep You Broke

Nov 14, 2025

The Great Money Paradox

Take a moment and look around.

We’re the most educated, interconnected, and informed generation in human history.

We can solve a Rubik’s Cube while streaming a tutorial on a device more powerful than the Apollo moon missions. We have access to every budgeting template, investment hack, and financial guide ever written—just two clicks away.

And yet…

-

Millions still live paycheck to paycheck.

-

Consumer debt is at an all-time high.

-

Retirement savings? More like a dream than plan.

We are Smarter Than Ever — and Broker Than Ever.

There’s a painful disconnect between what we know and what we do with money. The truth? It’s not about math — it’s about psychology.

The 3 Hidden Mind Traps That Make You Bad with Money

Every swipe of the card feels harmless, every “buy now, pay later” option feels convenient. Yet together, these choices form a cycle of financial self-sabotage that drains your wealth before you even notice. The system is designed to keep you trapped — and the triggers are hidden in plain sight. Once you recognize them, you can finally escape the cycle and reclaim control.

The reason we suck at money isn’t ignorance — it’s human nature. Behavioral economics has revealed the silent forces that hijack our decisions. Today's marketing machine knows how to use these triggers and get us to open our wallets. Let's examine a few:

- The Instant Gratification Trap — “I’ll Take $100 Today Over $200 Tomorrow"

This is hyperbolic discounting — your brain’s bias toward the “now.”

In prehistoric times, this kept us alive. Food today meant survival. But in modern times, it kills wealth.

You:

-

Buy the latest iPhone instead of investing in Apple.

-

Blow your bonus on a weekend trip instead of crushing high-interest debt.

You are biologically programmed to crave the quick win. Mastering money means outsmarting your own wiring.

-

- The Pain of Losing vs. The Joy of Winning — Why “Free” Isn’t Free

Nobel laureate Daniel Kahneman proved we feel losses twice as strongly as gains.

This explains why we:

-

Cling to losing stocks instead of cutting losses.

-

Avoid investing because “what if I lose it?”

-

Choose high-interest “no annual fee” cards to dodge a tiny visible cost while ignoring massive invisible ones.

We avoid small, visible losses — even if it leads to big, hidden ones.

-

- The “Keeping Up” Curse — The Joneses Got an Upgrade

You loved your 55-inch TV... until your neighbor bought a 70-inch OLED.

Welcome to reference dependence — the habit of measuring success by comparison.

Social media turned this into a global epidemic. Now your “neighbors” are influencers flaunting private jets and designer bags and in chasing their lifestyle, we sacrifice our freedom for fleeting validation.

Comparison kills contentment — and your bank balance.

The Modern Money Traps Built to Keep You Broke

It’s not all your fault. The system knows your weaknesses — and monetizes them.

- Subscription Overload — Death by $9.99

Your gym, Netflix, Apple Music, Canva, and that app you forgot about?

Each one feels tiny. Together, they drain thousands a year.These models thrive on inertia. It’s easier to keep paying than to cancel.

You’re not buying the service — you’re paying for the guilt of not using it. - The Disappearing Dollar — How Digital Spending Numbs the Pain

Once upon a time, spending hurt. You handed over cash and watched your wallet thin.

Now? Tap. Swipe. Click “Confirm Purchase.”

Money became invisible — and painless.“Buy Now, Pay Later” makes $1,000 feel like “just $50 a month.” The less real your money feels, the faster it disappears.

- The Debt-Industrial Complex — The House Always Wins

Credit card companies, BNPL apps, and lenders thrive on your future self’s misery.

They market rewards, points, and “flexibility” — not the crushing 24% interest that follows.

It’s a treadmill of illusion: you’re running harder but staying broke.Debt is not a tool — it’s a trap disguised as convenience.

How to Finally Outsmart Your Brain (and the System)

If money problems aren’t about math, the solution isn’t more spreadsheets. It’s about behavioral design — setting up systems that make saving automatic and spending painful.

- Automate Everything — Outsmart Your Impulses

You can’t outwill your biology. So automate it.

-

Auto-transfer savings on payday before you see the money.

-

Auto-pay bills to kill late fees.

Make saving the default and spending the effortful act. Pay your future self-first.

-

- Bring Back the Pain — Make Spending Tangible Again

Digital money feels fake. Cash doesn’t.

Try cash stuffing or the envelope system:

Withdraw cash for specific categories (groceries, dining, fun). When it’s gone, it’s gone.That tiny sting when handing over cash? That’s your best financial coach. - Redefine “Enough” — Escape the Comparison Trap

You’ll never feel rich if you measure yourself against others. The wealthiest people quietly opt out of that game. Unfollow accounts that fuel envy. Write down what enough looks like for you — and stop moving the goalpost.

Peace begins when your definition of success stops being someone else’s highlight reel.

If you’ve ever felt like you’re doing everything “right” with money but still can’t seem to get ahead — you’re not alone. The system was never built for you to win.

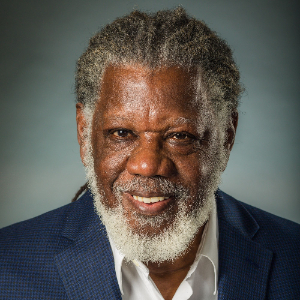

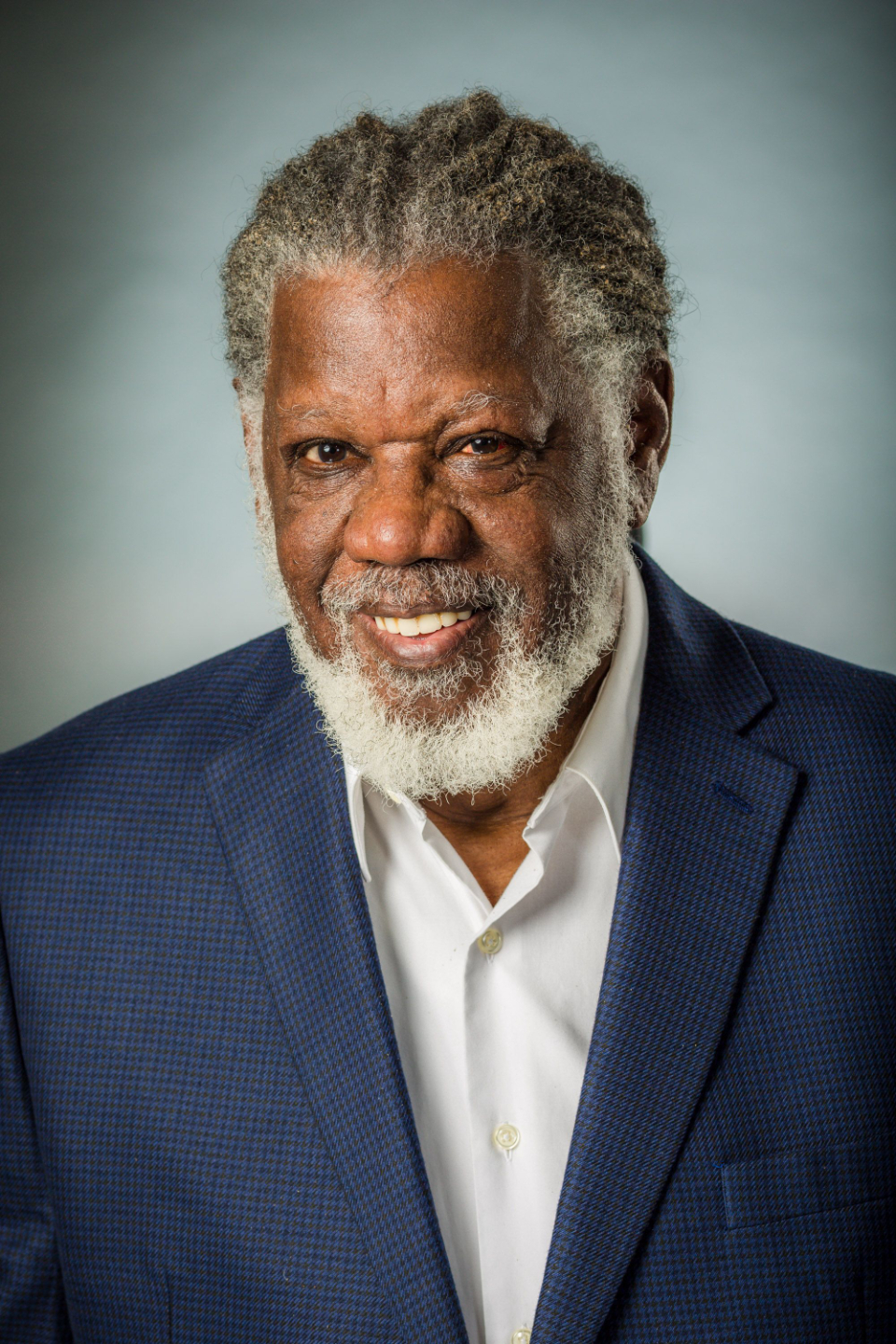

The Higher Ground Community is where we rise above that. It’s a space for people who are done playing the game by broken rules — and ready to build wealth with awareness, clarity, and purpose.

Get insights that challenge the norm, rewire how you think about money, and help you design a financial life that actually feels like freedom.

There is power, healing and strength in community. Join with others and you will go further, faster.

Click the Image to learn more:

Share it forward: If this helped you, share it with someone who needs it today.

We are spreading the word that financial clarity and freedom can be available for everyone. Live your best life and reach Higher Ground in a community of likeminded people.

We hate SPAM. We will never sell your information, for any reason.