You Might Be Ready for Financial Change If…

Feb 17, 2026Most people don’t wake up one morning and decide to “get their finances together.” Financial change rarely starts with motivation. It starts with a feeling—a quiet one. Not panic. Not crisis. Just a growing sense that something isn’t quite right. If that sounds familiar, you may be closer to meaningful financial change than you think. Here are a few signs you might be ready—whether you realize it or not.

1. You earn decent money, but don’t feel confident about it.

From the outside, things look fine. Bills get paid. Income is steady. Nothing is “wrong.” And yet, confidence is missing. You’re not sure if you’re saving enough or if today’s decisions are helping or hurting tomorrow. That uncertainty isn’t a failure. It’s usually a sign that effort has replaced clarity.

2. You feel behind, but can’t explain why

This one is frustrating. You’re not struggling in obvious ways, but it still feels like you’re behind. Often, that feeling comes from comparison mixed with a lack of structure. Feeling behind doesn’t mean you are behind; it often means you don’t have a way to measure what “on track” actually looks like.

3. You’ve tried to “do the right things,” but nothing feels settled

You’ve heard the advice: save more, budget better, invest early. But instead of peace, you feel tension because tactics without order create noise. Clarity isn’t about doing more. It’s about knowing what matters first.

Guessing is exhausting—guessing how much to save or if you should invest. At some point, even capable people reach a limit because guessing is not a sustainable strategy. Wanting clarity is not weakness. It’s readiness.

5. You’re afraid of making the wrong move

This fear comes from awareness. You know small mistakes compound . That hesitation is a signal that you value alignment over impulse—and that’s a strength.

6. You want calm more than you want complexity

At some point, the goal shifts. It’s no longer about optimization or chasing the perfect strategy.

It’s about peace of mind.

You want to:

✔️ Understand what you’re doing

✔️ Trust your decisions

✔️ Feel grounded instead of reactive

Calm doesn’t come from having more options. It comes from having fewer, clearer ones.

7. You don’t want a quick fix—you want direction

You aren't chasing hacks or shortcuts. You want a path you can follow with confidence. When someone reaches this point, real change becomes possible.

What This Actually Means

If several of these signs resonate, it doesn’t mean you’re behind. It means you’ve outgrown guessing. Most people don’t fail financially because they lack discipline or intelligence.

They struggle because no one ever showed them a clear order. Clarity comes before confidence. Structure comes before growth.

And once those are in place, progress stops feeling stressful—and starts feeling intentional. Before trying to earn more, save more, or invest more, it helps to understand where you actually stand.

Not in a judgmental way. Not in a “good or bad with money” way. Just clarity.

If you want that, a short financial clarity check can help you see:

-

What’s working

-

What’s missing

-

What to focus on first

No hype. No pressure. Just direction. Because meaningful financial change doesn’t start with doing more. It starts with knowing what to do next.

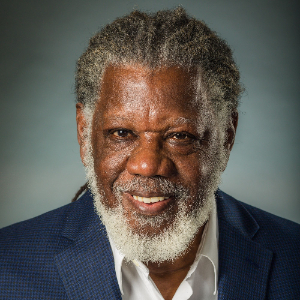

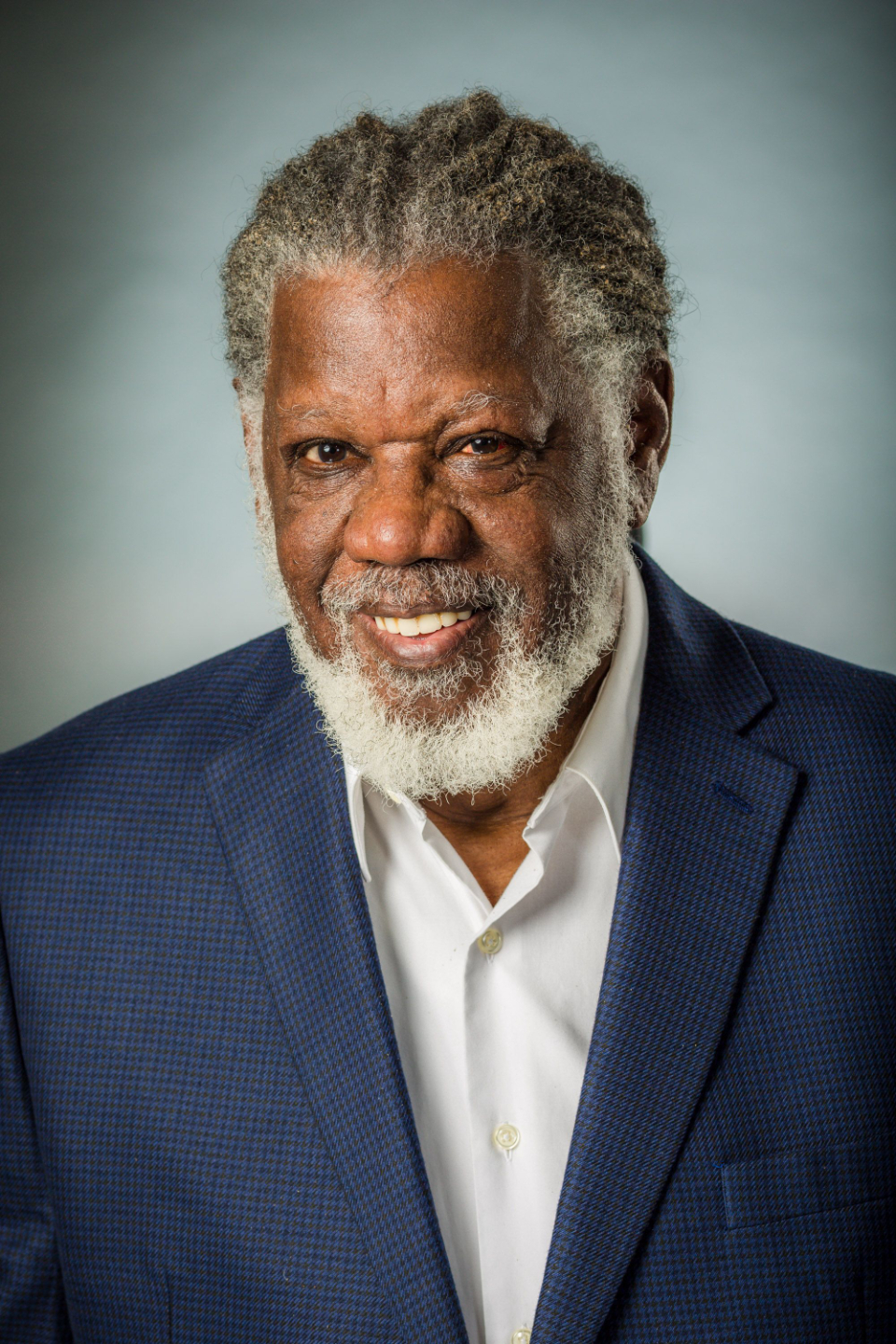

We are spreading the word that financial clarity and freedom can be available for everyone. Live your best life and reach Higher Ground in a community of likeminded people.

We hate SPAM. We will never sell your information, for any reason.