Budgeting is Not a Diet: 5 Steps to a Sustainable Spending Plan

Oct 02, 2025

When people hear the word “budget,” the first thought is often restriction. It brings to mind saying no to coffee runs, dinners out, shopping, or anything that feels enjoyable. Budgeting becomes associated with sacrifice and denial, much like going on a strict crash diet. At first, it may feel empowering, but soon the sense of deprivation leads to burnout. A week or two of discipline is followed by a “slip,” which brings guilt, frustration, and eventually abandonment of the plan.

This is not real budgeting. A true plan for your money is not meant to feel like punishment. It is designed to give you direction and control. Think of it as a spending plan—a roadmap that helps you prioritize what matters most while allowing you to enjoy life. A spending plan is about building balance, not cutting out everything you love.

Shifting the Mindset: From Restriction to Empowerment

The most important step in creating a successful plan begins with your mindset. Many traditional budgeting methods reinforce the belief that budgets are financial straitjackets. Zero-based budgeting, where every dollar is assigned a task, is often promoted as the gold standard. Yet, in practice, it rarely lasts. Constant restriction creates the very behavior it tries to prevent. When you continually tell yourself that you cannot spend, your natural response is to resist by overspending.

A spending plan works differently. It acknowledges that spending is a natural and enjoyable part of life. Instead of imposing temporary rules, it provides a system you can live with for the long term. It is the difference between a crash diet and a healthy, sustainable way of eating. By designing a flexible system that reflects your lifestyle, you remove the guilt and create a path to lasting results.

Step 1: Know Your Numbers

You cannot control money you do not track. The first step is awareness. For one month, write down everything you earn and everything you spend. Do not judge the results, just observe. This can be done in a notebook, a simple spreadsheet, or through free budgeting apps such as YNAB or Quicken.

Most people are surprised by what they discover. Studies show that the average American spends more than $1,000 - $1,500 a year on unused subscriptions alone. These hidden leaks often go unnoticed until you track them. The purpose of this exercise is not self-criticism but clarity. Once you see where your money is going, you can make informed decisions rather than relying on assumptions.

Step 2: Define Your Goals

Numbers by themselves will not keep you motivated. To stay committed, you need a meaningful reason. Goals give context and purpose to your spending plan. Ask yourself whether your priority is paying off credit card debt, saving for a down payment on a house, building an emergency fund, or preparing for a major purchase or life experience.

When you identify the specific outcome you are working toward, the plan becomes more than a list of expenses. It transforms into a tool that supports your larger vision. Writing down your goals and keeping them visible can serve as a reminder in moments when you are tempted to overspend. Clear goals provide direction and a sense of excitement about your progress.

Step 3: Use the 50/30/20 Rule

A flexible framework is far more effective than rigid tracking. The 50/30/20 rule is one of the most practical methods to build a spending plan that balances needs, wants, and savings. Allocate 50 percent of your income to essentials such as rent, food, utilities, transportation, and minimum debt payments. Assign 30 percent to discretionary spending, including dining out, shopping, hobbies, and travel. Reserve the remaining 20 percent for savings, investments, and extra debt reduction.

This method works because it creates structure without micromanagement. It allows you to save consistently while leaving room for enjoyment. The flexibility makes it sustainable over time. Unlike traditional budgets, it does not demand perfection but provides a system that adapts to real life.

Step 4: Automate Your Savings

The most effective way to ensure long-term success is automation. Once you understand your numbers and set your goals, arrange for automatic transfers into savings or investment accounts each payday. By paying yourself first, you remove the temptation to spend money that should have been saved.

Step 4: Automate Your Savings

The most effective way to ensure long-term success is automation. Once you understand your numbers and set your goals, arrange for automatic transfers into savings or investment accounts each payday. By paying yourself first, you remove the temptation to spend money that should have been saved.

Research supports the power of automation. Studies show that using automatic transfers and default savings mechanisms leads to significantly higher participation and faster accumulation of savings over time. For example, research by the Wharton Pension Research Council notes that automatic enrollment into retirement savings plans can boost participation by as much as 86%. Pension Research Council Automation helps turn good intentions into consistent results, because it doesn’t rely on willpower. It quietly builds wealth in the background, giving you security and steady progress without extra stress.

Step 5: Check In Weekly

A plan only works if you consistently monitor it. Set aside 15 minutes each week to review your accounts and spending. Ask yourself whether you are still on track with your goals, whether you spent more than expected in any category, and how you can make adjustments in the week ahead.

This review is not about guilt but about small course corrections. If groceries cost more than planned, you can reduce spending in dining out or entertainment the following week. These minor adjustments keep your plan flexible and effective. A weekly check-in acts like a financial compass, ensuring you are always moving in the right direction without ever feeling lost.

Why Fun Spending is Essential

The biggest mistake people make is treating enjoyment as a luxury. A sustainable spending plan must include room for fun. Without it, you risk abandoning the plan altogether. This is why the “wants” category in the 50/30/20 rule is so important. Allocating money for hobbies, dining, or leisure activities prevents feelings of deprivation and builds balance into your financial life.

Far from being irresponsible, planned fun spending strengthens discipline. It allows you to enjoy the present while working toward the future. When you know that your plan includes room for enjoyment, you are far more likely to stick with it for the long term

From Dieting to Thriving

A budget is not a diet, and a spending plan is not a punishment. It is a tool for creating freedom. By shifting your mindset, tracking your numbers, defining meaningful goals, applying a flexible framework, automating savings, and checking in regularly, you build a system that works in real life.

This approach allows you to stop viewing money management as a list of sacrifices and start seeing it as a pathway to a more intentional life. A spending plan ensures that you are not simply cutting back but creating the space to say yes to what matters most. Shifting your financial mindset and building a sustainable system takes ongoing support and accountability. If you’re ready to move past the financial "crash diets" and build true, lasting financial health, you don't have to do it alone.

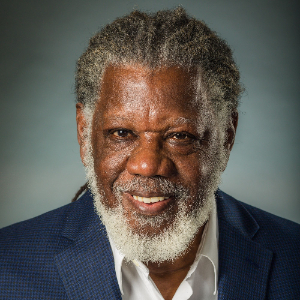

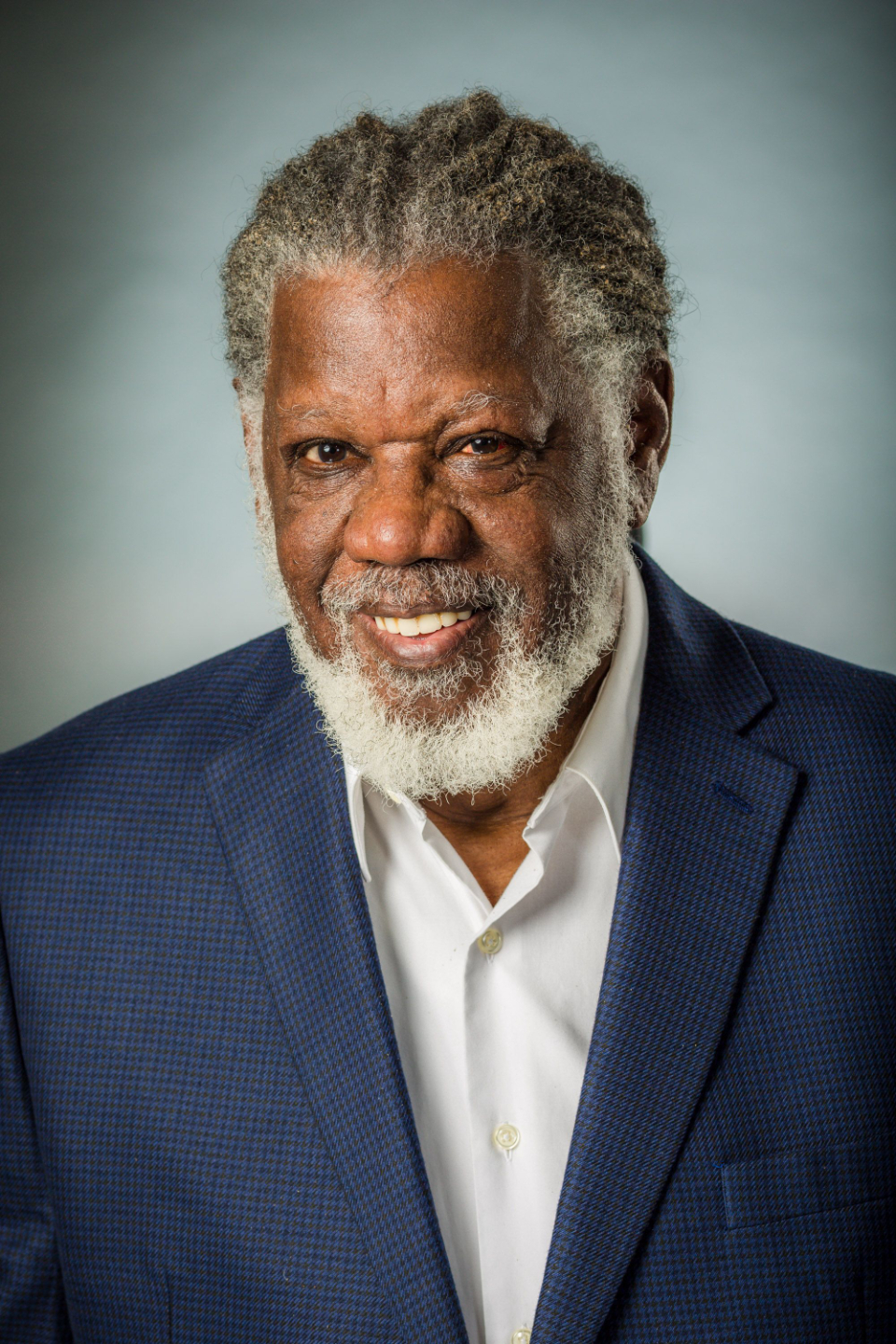

With The Higher Ground Membership and Community, you'll find the practical guidance and non-judgmental community to help you implement your spending plan, stay consistent with your check-ins, and celebrate every step toward financial freedom. It's the support system you need to make your spending plan a system for thriving, not just surviving.

We are spreading the word that financial clarity and freedom can be available for everyone. Live your best life and reach Higher Ground in a community of likeminded people.

We hate SPAM. We will never sell your information, for any reason.